1454433

12996

1348486

1440658

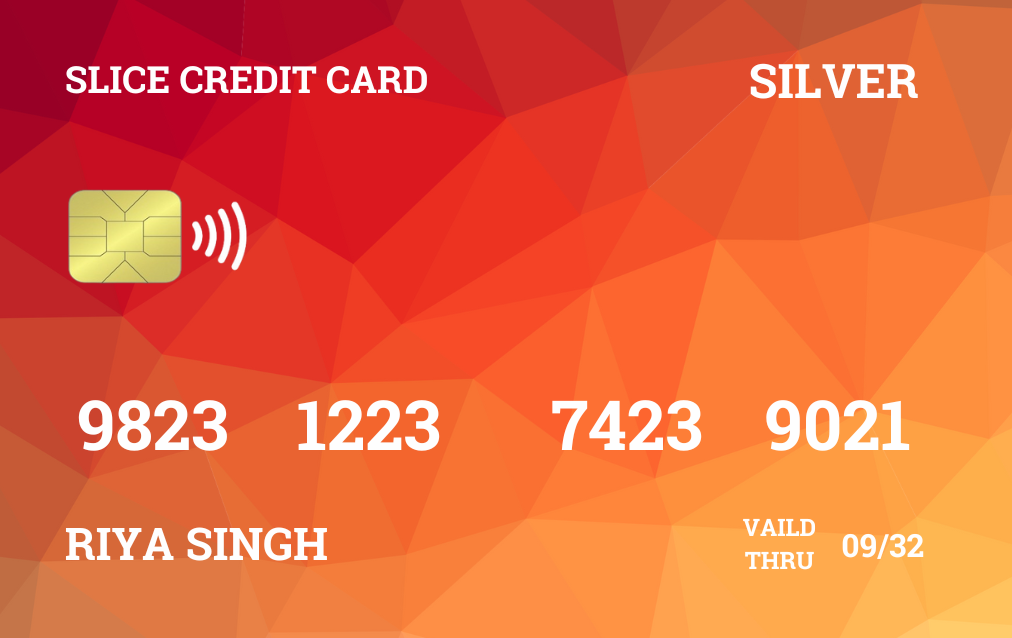

Get 2%* cashback on all your Online spends, up to a maximum of Rs 1000 per month.

Get 1%* cashback on your other spends, up to a maximum of Rs 500 per month. Fuel transactions are not eligible for cashback

Enjoy an extended interest free credit period for the first 90 days post credit card issuance by paying only the minimum amount due.

Convert your transactions into EMIs at special interest rate of 0.99% per month at Nil processing fees

No annual fee shall be charged on spend of Rs 30000 or more in a membership year (a year from the date of issuance of the card), else fee of Rs 1,000 will be charged at the end of the said year

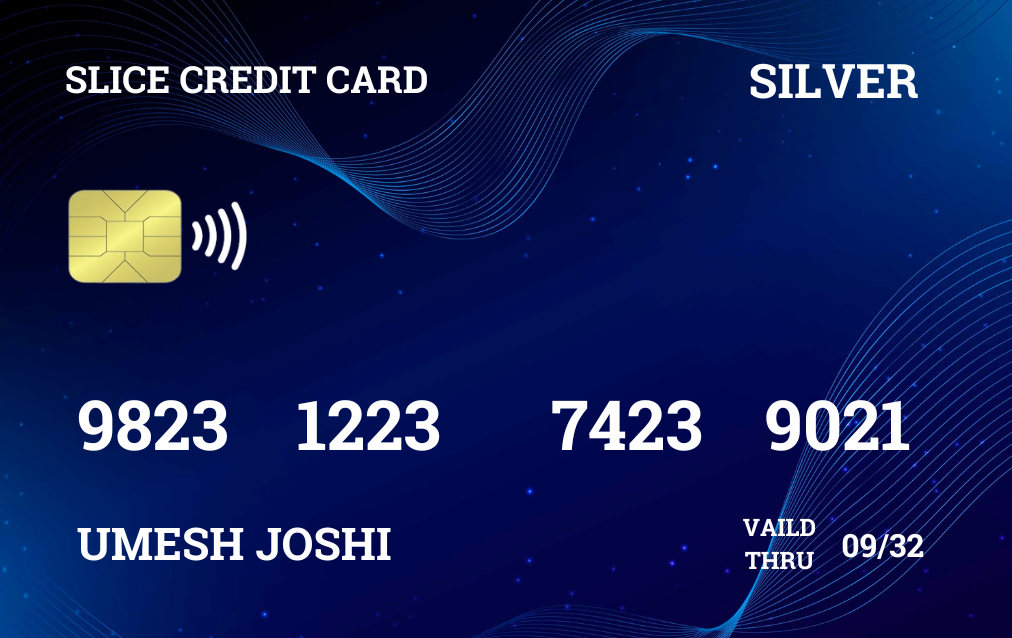

Earn 1,250 bonus Scene+ points upon first purchase5.

Get 3%* cashback on your other spends, up to a maximum of Rs 500 per month. Fuel transactions are not eligible for cashback

5% cashback* on duty free spends and access to over 1000 airport lounges across the world.

Among a distinct credit card advantage is the fact that a credit card can be used for buying flagship items at affordable EMIs. These can be repaid over a duration you can select.

Another advantage of a credit card over a debit card is that you can also withdraw advance cash from ATMs with the facility of repaying amounts when you have to settle your bill.

A credit card is a digital instrument that offers you safety in payments. With multi-factor authentication and in-hand security features, you needn��t have cause to be concerned.

Credit card perks are the discounts and offers you can avail of on a range of products.you get reward points on the basis of your spending and the kind of credit card you use.

Getting a credit card is now easier and quicker. Apply for your card online without any documentation while we set up your savings account. During the account opening journey, give consent to check your CIBIL score and continue your account opening journey and we will check your eligibility for the card. Basis eligibility, on the Thank you page, you can complete the credit card application by submitting your employment details.

Cash Limit is the amount included in the credit limit assigned to your card account that can be withdrawn as cash.

Cash withdrawal from your credit card is subject to applicability of interest charges and cash withdrawal fee.

A credit card is a simple and efficient way to make payments.It negates the need to carry cash or issue checks and is designed to make spending a rewarding experience.It is the perfect way to handle all physical and online payments and has you covered in the event of a cash emergency too.

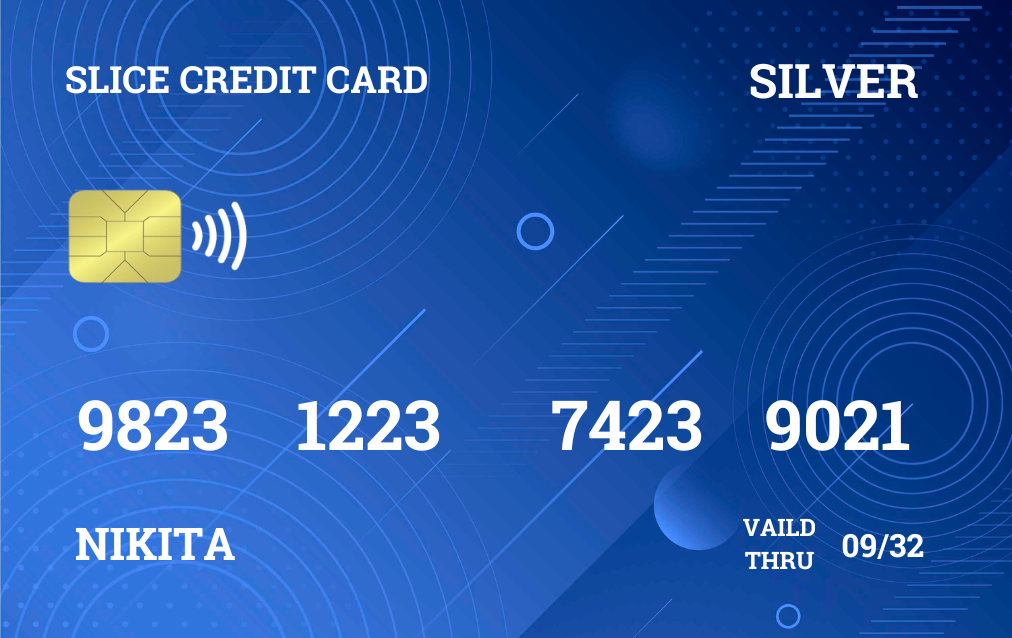

Slice Credit Cards provide you with a plethora of additional benefits to enhance your premium lifestyle.

With a Slice Credit Card, you earn cashback on making payments for fuel and other utility bills including your phone bill.

Movie buffs can especially appreciate our credit card rewards on entertainment and movie expenses. Treat yourself with the premium benefits available to you at a multitude of fine dining restaurants too.

Slice Credit Cards allow you to convert any large transaction into an EMI. You can transfer credit card balance and even balance payment on EMI.

Every contactless credit card purchase presents varied redemption options from our vast catalogue of luxury products and services.